“A report claiming that Twitter received an offer to be acquired for $31bn attributed to Bloomberg LP is fake, Twitter and a spokesman for the news and financial data provider said on Tuesday,” Reuters reported on Tuesday.

Some $31bn is a 34.8% premium against Twitter‘s market cap on Tuesday.

That is about $8bn.

Interesting.

We investigated more serious stuff, however.

Story, What Story?

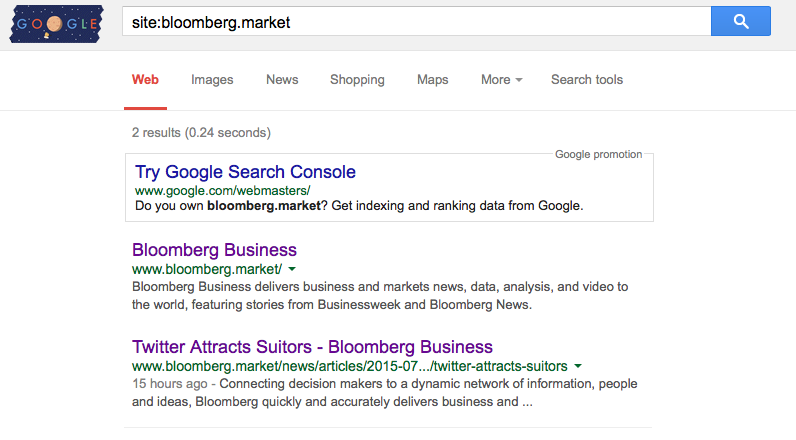

There is no Bloomberg story on the web about a takeover of Twitter.

Nowhere.

If you can find it, give us a shout.

Chill out, though.

We did our homework (this story is public, but to get it you must have a basic grasp of Google operators, the content of which is recorded on Google only in cache mode).

Noteworthy: the account that reported the news has been suspended for a few hours, but it’s still indexed, as the chart below shows.

(Our team has investigated the issue concerning the reported takeover of Twitter, which emerged on Tuesday. There is reason to believe, in our view, that some IT developers had a lot of fun trying to mislead the market by divulging a domain that should have not been made public. The obvious questions is: did Bloomberg forget to register bloomberg.market?)

Domain

We found out that a new domain for bloomberg.market — guess what pops up: “This Account Has Been Suspended” — was created on 10 July (Location: Georgia, Atlanta; Bloomberg Business; registered in Panama; ip address 68.65.122.42), and God knows why there’s no track record before then.

There’s a telephone number: +507.8365503.

We called.

We were not lucky enough to get an answer.

Leave a voicemail if you can get through.

Do you want a fax number?

There you go: +51.17057182.

Your best guess is just as good as ours.

Yet we did expect this kind of rumour sooner rather than later — social is not the way forward, and Twitter is troubled, quite simply.

Incidentally, consider that when Bloomberg gets its stories on the wire, it seldom gets it wrong.

Stock Down

Twitter stock has dropped a lot in recent weeks.

It gets a fillip now from takeover rumours, although the stock was up less than 3% on Tuesday — not much, to be fair.

Tuesday was a nice day to cash in for investors who have recorded a paper loss this year (-30% since the end of April; -2% this year).

In fairness, however, the bulls may need more than rumours to abandon their Twitter trade.

Right.

They may need a sound strategy — and equally important, what’s next?

Twitter is not a takeover target for 4 very simple reasons:

- The market says its valuation is 39x and 23x Ebitda for 2015 and 2016, respectively. That is rich.

- Nobody is going to pay that much for such a target.

- At IPO, the stock was already overvalued.

- To our knowledge at the time of writing, there is no statement from Twitter about the matter.

(Laura Pasetti contributed to this article.)

If you want to discuss this topic with our team, please email us at info@hedgingbeta.com.

(Alessandro Pasetti and Hedging Beta are not invested in any of the shares mentioned in this article.)